I’ve been an advocate of Working at Home for years.. and have been doing it even before it was cool. And one of the biggest problems of those that Work At Home face is the lack of digital support for most things for daily life. And one of the 1st companies in Fintech to rise up to the challenge in solving these problems is Mynt. Here are 5 of the 1st’s that GCash helped solve for the online community.

-

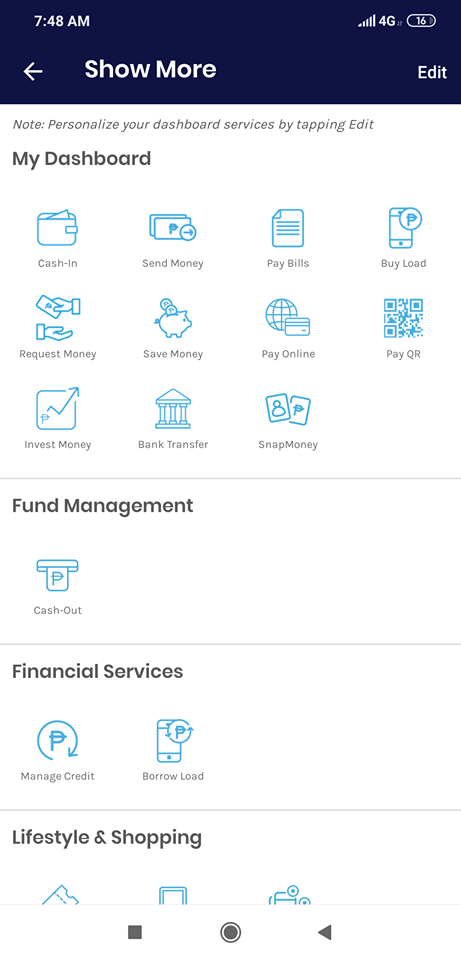

- 1st to allow Paypal to GCash transfers.. For online workers, being able to transfer funds fast and safe from Paypal to one’s personal account is the biggest challenge and worries. A lot used to resort to 3rd party encashers with a significant number being scammed on both sides.. Now, you can transfer your Paypal funds fast to your GCash account and withdraw it via the ATM or start paying for the things you need via the app.. By the way – for easier and hassle free transfers.. make sure you change your funding money to PHP in Paypal before transferring.

- 1st to launch the QR Code payment – paying for purchases using your mobile phone was one of the other things that GCash solved. Imagine having left your wallet behind or just ran out of cash on hand.. GCash was one of the 1st to launch paying for things using a QR code you scanned with your mobile phone and transferring funds to the vendor via GCash.

- 1st to launch a closed loop credit system. Running out of funds on the GCash app or just your normal bank account is made a lot bearable with GCredit. Mynt has come up with a way to score GCash users and let them get loans with GCredit and use it to pay valid with GCash partners like Meralco Bills or even Coffee.

- 1st to launch an investment portfolio which is powered by ATRAM which is one of the leaders in the industry. Money you invest earns a specific interest rate on a monthly basis which is considered higher that just leaving your money in a conventional bank

- Transferring funds or Sending money to banks via Bank transfers through InstaPay with your GCash funds is as easy as 1,2 and 3..You can easily to send money to any 32 banks in the Philippines almost instantly thanks to their partnership with InstaPay. And to top it off.. It’s free! No service charges.

Why do I love using Fintech services like GCash from Mynt? Those 5 services I mentioned are all features and services provided.. but what does those features translate into benefits for us consumers? For the bank transfers via InstaPay. Have you ever been in a bank lately? You spend an average of 20 minutes to 1 hour just to deposit funds to your account or someone else’s account.. same with paying your bills. Now, I don’t have to go out of the house most days just to send money to my relatives, friends or even coworkers, all I have to do is load up on my GCash account and instantly transfer to their GCash accounts or deposit straight to their bank accounts!